If you’ve been looking into buying a home, then you probably already know that interest rates are higher than they were last year. Today, the 30-year Fixed Rate Mortgage has risen to nearly 7%, compared to approximately 3% a year ago (Freddie Mac). Rising rates have led many prospective home buyers to wonder if purchasing a home is still possible.

Fortunately, there are programs specifically designed to help home buyers afford homes even when interest rates are high. Temporary buydown programs offer a solution for those who want to purchase a home, offering to “buy down” the current interest rate. We’ll break down different temporary buydown programs, how a buydown works, and examples of what this could look like for a potential buyer.

Make your homeownership dreams a reality.

Take the first step and apply online with FBC Mortgage.

Make your homeownership dreams a reality.

What is a mortgage rate and why does it matter?

To understand buydown programs, it’s best to first understand mortgage rates. Mortgage rates are affected by a variety of factors and can be impacted heavily by the market. Mortgage lenders take a variety of considerations into account when setting rates, such as credit score, the size of the loan, the state of the economy, the Federal Reserve interest rate, and other economic factors. If you want to learn more about how mortgage rates are determined, check out this article by Nerd Wallet.

Your mortgage rate can substantially affect your monthly payment and buying power. Forbes.com helps to put this into perspective: “On a mortgage of $300,000 the increase from 3% to 7% would mean the average monthly payment has increased from $1,265 up to $1,996.” That is a difference of $731 each month and $8,772 a year. This is where a temporary buydown program can help increase affordability for home buyers when rates are high.

What is a temporary buydown and how does it help buyers deal with high mortgage rates?

Temporary buydown programs offer a reduction in mortgage rate for a set amount of time, which can help to lower the initial payments of your loan. After the temporary buydown period has ended, your mortgage will return to its original rate. Many temporary buydown programs offer closing cost assistance from the seller which can also help to cover payments.

Unlike Adjustable-Rate Mortgages (ARM), which offer a set rate for an initial period and then adjust every year, temporary buydowns provide you with certainty on your current and future interest rate for your loan.

A temporary buydown is also different from a standard buydown. When you opt in for a standard buydown program, you are paying a fee in the form of discount points (sometimes referred to as mortgage points) in order to obtain a lower interest rate for a specific period of time agreed upon by the lender.

In contrast, temporary buydown programs are structured so that the seller or builder is paying the interest on the loan for the first few years of the agreement. That money goes into an escrow account which is paid to the lender. If you choose to refinance, any money that was paid during the temporary buydown is accounted for in your escrow. If you want to learn more about how a temporary buydown works, visit Fannie Mae’s website.

How temporary buydown programs increase affordability

Sometimes the best way to understand something is to see an example. We have broken down 3 different potential temporary buydown programs below so that you can get a feel for how these programs work. Temporary buydown programs can help to lower your monthly payments and increase your yearly savings. Please note, these are examples only. Contact us to get up to date information on current buydown programs and rates!

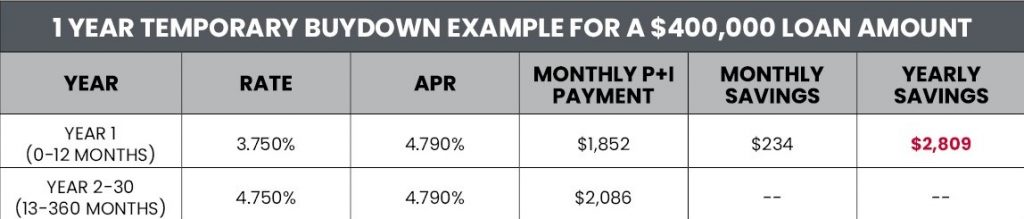

1/0 Buydown

Example payment does not include taxes or insurance and payment obligation will be greater. Scenario is an estimate only and is based on 740 FICO score and a 1/0 buy down on a Conventional fixed rate loan at $400,000 at 80% LTV with a starting rate at 3.75% and an end rate of 4.75% and APR of 4.790%, 30 year agreement (360 months). *1/0 Buydown Program: Rate reduction up to 1%; buy down rate for up to 1 year; builder, seller or third-party can pay for buy down; adjusts 1% each year; returns to original fixed rate after buy down period. Please reverify the buydown costs prior to closing.

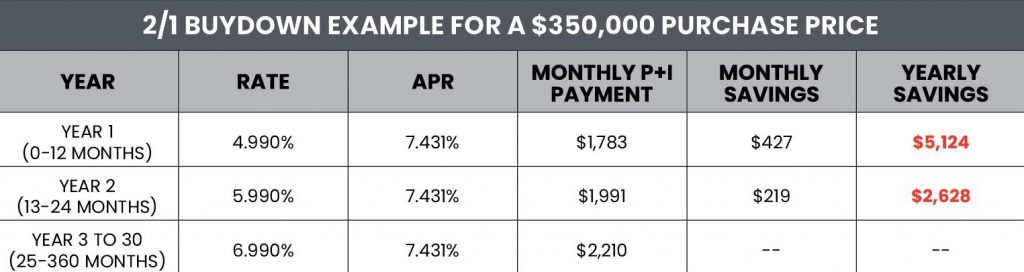

2/1 BUYDOWN

Scenario is an estimate only and is based on 740 FICO score and a 2/1 buydown on a total Conventional loan amount of $332,500, at a 95% LTV with a starting rate of 4.990% with an APR of 7.375% and an end rate of 6.990% with an APR of 7.375%, 30 year agreement (360 months). Monthly payment estimates include principal and interest only and do not include taxes or insurance; actual payment obligation will be greater. *2/1 Buydown Program: Rate reduction up to 2%; buy down rate for up to 2 years; builder, seller or third-party can pay for buy down; adjusts 1% each year; returns to original fixed rate after buy down period. Please reverify the buydown costs prior to closing.

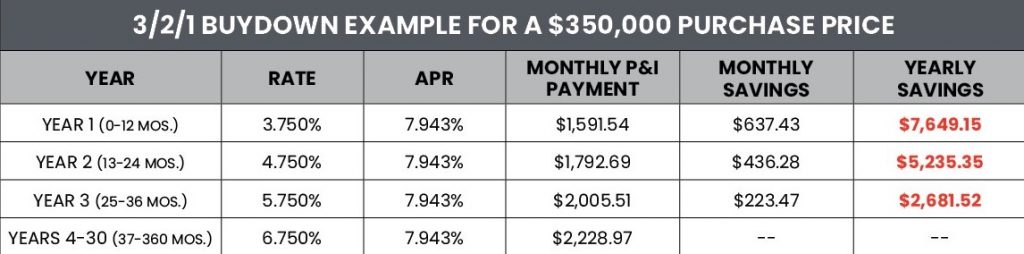

3/2/1 BUYDOWN

Scenario is an estimate only and is based on 700 FICO score and a 3/2/1 buydown on a total FHA loan amount of $343,660, at a 96.5% LTV, 30 year agreement (360 months). Monthly payments are estimates and include principal and interest, but do not include taxes, insurances, or HOA fees (if applicable) and actual payment obligation may be greater. *3/2/1 Buydown Program: Rate reduction up to 3%; buy down rate for up to 3 years; builder, seller or third-party can pay for buy down; adjusts 1% each year; returns to original fixed rate after buy down period. Please reverify the buydown costs prior to closing.

These examples are for demonstration purposes only. Please reverify the temporary buydown costs prior to closing. All products are subject to credit and property approval. Programs, rates, program terms and conditions subject to change without notice. Not all products are available in all states or for all amounts. Other restrictions and limitations apply. See a FBC Mortgage, LLC Mortgage Loan Originator for details. This is not a commitment to lend. www.nmlsconsumeraccess.org

Ready to learn more?

Connect with one of our loan officers in your area today.

Ready to learn more?

As seen in the examples above, temporary buydown programs can help increase affordability for home buyers by reducing their interest rate in the first few years of their loan depending on the program. There are many aspects that can help determine if a temporary buydown is right for you. Before deciding on your next step in the home buying process, it’s a good idea to speak with a mortgage professional who can walk you through options and help you determine what loan program is the best fit for your needs. Contact us to speak with our experienced team of mortgage professionals today!

Why Choose FBC Mortgage?

FBC Mortgage, LLC is a leader in helping home buyers with fast and simple loans. We’re dedicated to exceptional customer service and are always available when you need us most, even at night and on the weekend. We’ll help you navigate your new home purchase, and keep you updated along the way with weekly check ins, so you know you’re taken care of. That’s one of the many reasons why 95% of our clients would recommend us to their friends and family. It’s also why the nation’s top home builders and Realtors trust FBC to help their new home buyers.

Buying a home is one of the most important financial decisions you will make. Understanding mortgages and the home buying process can help make it less stressful, and so can partnering with a mortgage lender you can trust. At FBC Mortgage, LLC, we’re dedicated to helping home buyers finance their dream home.

All information presented is for educational purposes only and not intended as financial advice. FBC Mortgage, LLC is a national mortgage lender headquartered in Orlando, Florida. Specializing in residential mortgage lending, including purchase, refinance, construction, and renovation loans. See what our clients have to say. NMLS#152859 EHL ©2021.

How to Read Your Closing Disclosure

Learn how to read your Closing Disclosure, including all the final details about your mortgage like the loan terms, monthly payment, and how much you owe in fees and closing costs.

Your Guide to A Stress-Free Moving Day

Moving can feel overwhelming, but it doesn’t have to! Whether you’re moving across town or across the country, these helpful tips will make your move as seamless as possible.

Upgrade Your Backyard with A HomeStyle Lite Pool Loan

With one set of closing costs and a streamlined process, the HomeStyle Lite Pool Loan is a great solution for current and aspiring homeowners who are looking to elevate their backyard.