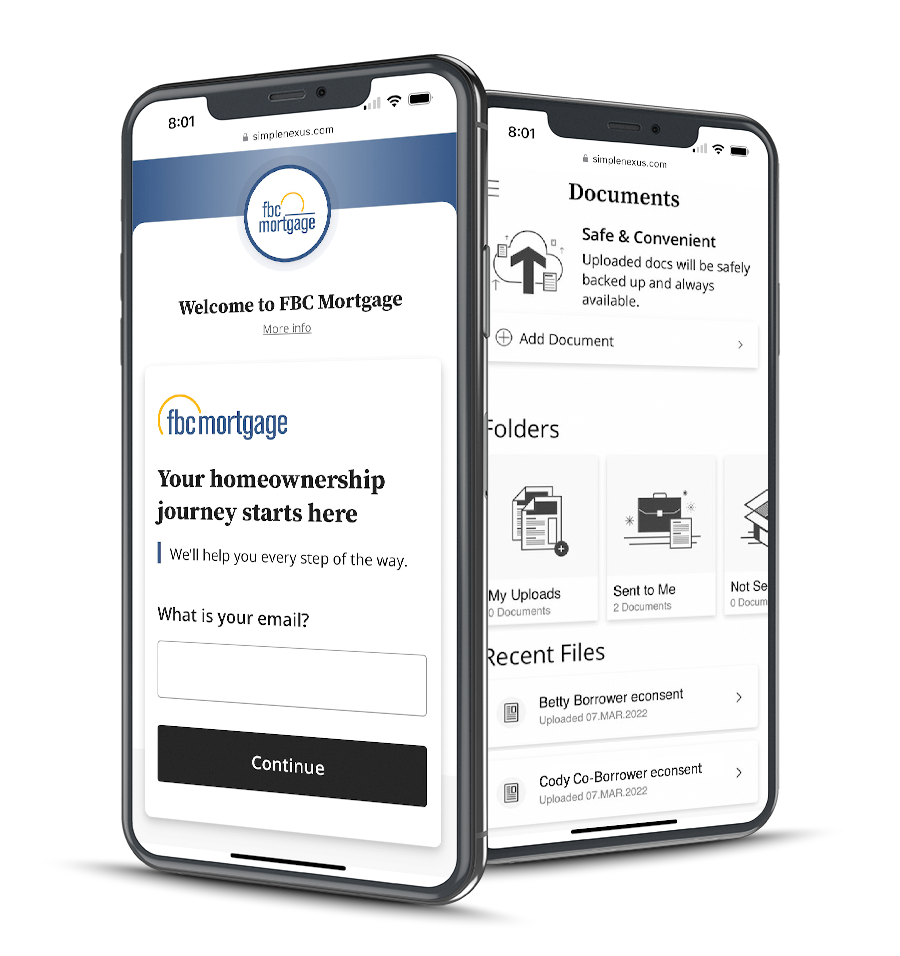

Our easy-to-use digital mortgage app makes homebuying simple

CALCULATE YOUR MORTGAGE OPTIONS

GET PRE-QUALIFIED OR PRE-APPROVED*

AUTOMATICALLY VERIFY YOUR INFORMATION

REAL-TIME STATUS AND NOTIFICATIONS

SCAN DOCUMENTS

MESSAGE YOUR LOAN TEAM

SIGN DISCLOSURES

SUBMIT PAYMENTS

AUTHORIZE CREDIT REPORTING

*“Pre-Approval” means an automated underwriting system approval (conditional approval) based upon credit information supplied by applicant and subject to FBC Mortgage, LLC’s review of loan documents. Not all applicants will be approved.

our blog

Featured Articles

FBC Mortgage Officially Rebrands as Acrisure Mortgage July 1, 2025

Whether you’re looking to establish permanent residence, purchase a vacation home, or invest in U.S. real estate, Foreign National loans can help you achieve your goals.

Home Financing for Foreign Nationals

Whether you’re looking to establish permanent residence, purchase a vacation home, or invest in U.S. real estate, Foreign National loans can help you achieve your goals.

Maximizing Your Home Equity

Homeownership comes with many advantages. Explore three ways to maximize your home equity: Home Equity Line of Credit (HELOC), Home Equity Loan (HELOAN), and Cash-Out Refinance.