On September 18th, the Federal Reserve announced a 0.5% cut on the benchmark rate with projected rates lowering another half a percentage point by the end of this year. Federal Reserve Chair Jerome Powell characterized the recent interest rate adjustment as a “recalibration” designed to uphold the strength of the labor market while guiding inflation toward the Fed’s 2% goal. What do lower rates mean for you as a homeowner, homebuyer, or home seller? In this article, we’ll dive into how interest rate cuts could benefit you.

Make your homeownership dreams a reality.

Take the first step and apply online with FBC Mortgage.

Make your homeownership dreams a reality.

How Lower Rates Benefit Homeowners

Lower rates mean that homeowners may have the opportunity to refinance their existing mortgages. Refinancing while rates are low could help you reduce your monthly payment, shorten your loan term, or tap into your home’s equity. If you’re currently paying PMI (private mortgage insurance), you may be able to refinance and eliminate that cost, depending on how much equity you have in your home.

Reducing your interest rate can result in lower costs over the lifetime of your loan and a lower monthly payment, which means more money to spend on the things that matter to you most. Lowering your current interest rate isn’t your only option when it comes to refinancing. You can use your home equity to fund home improvements, make major purchases, or consolidate high-interest debt.

FBC Tip

Check out Refinancing 101 to learn the basics and see how refinancing might be beneficial for you.

How Lower Rates Benefit Homebuyers

If you are in the market for a new home, lower interest rates can help to lower monthly mortgage payments and increase affordability. “Today’s rate allows for a borrower to have $45,000 in extra purchasing power, compared to budgeting based on rates from January 2024,” says Jay Zerquera, Regional Manager of FBC Mortgage, LLC. When rates are lower, buyers may have the chance to qualify for a higher loan amount, increasing their purchasing power and allowing them to get more home for less. “This extra purchasing power helps borrowers to get that bigger home that was slightly out of reach earlier in the year,” adds Jay Zerquera.

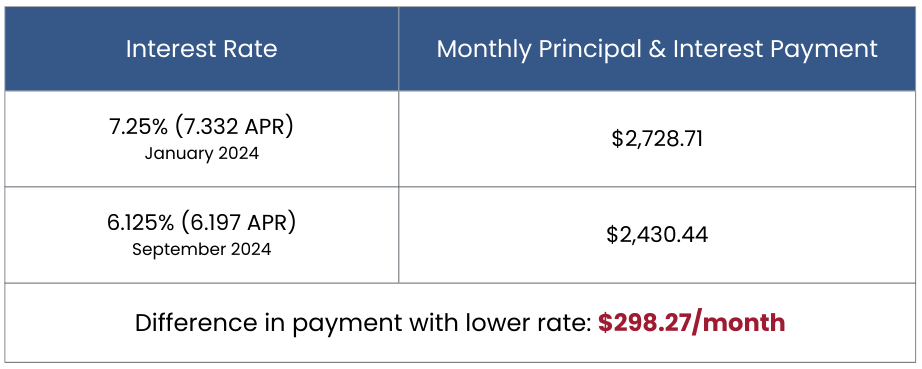

Lower rates can also help borrowers that were not able to buy due to debt-to-income ratio issues re-enter the market. Take a look at the chart below to see how a lower interest rate can impact your monthly principal and interest (also called P&I) payment – taxes and insurance not included.

The above chart is an example only. Rates listed are hypothetical. Payment scenario is an estimate and based on a $500,000 purchase price with a Conventional loan amount of $400,000 (80% LTV), 30-year fixed agreement (360 months), 760 FICO. Example payment does not include taxes, homeowners insurance, HOA or CDD (if applicable) and payment obligation may be greater.

Based on the above chart, today’s homebuyers could save approximately $300/mo, or $3,600 per year compared to January 2024 rates. With lower rates on the way, the potential to save even more could help borrowers looking to buy. This may be your chance to move into your dream home without stretching your budget too thin.

FBC Tip

Ready to start looking? Check out Debunking Common Mortgage Myths for some helpful advice on how mortgages work.

How Lower Rates Benefit Home Sellers

For home sellers, lower rates can help increase the demand for homes. Aspiring homebuyers who may have pressed pause on their search may now find home ownership more affordable and attractive. As more buyers enter the market, the increased competition means you’re less likely to need seller-paid concessions to close the deal, and your home could sell much faster. Plus, you are more likely to get your asking price – or even higher!

In addition, lower rates could make moving more affordable. The gap between your current mortgage rate and the new rate you would take on is smaller, making it easier to make the move. If you’ve been waiting to sell due to the “lock-in” effect, a rate cut could be the stepping stone that gets you to your next chapter.

FBC Tip

Learn ways to help maximize your home’s value and land you in a good place for the next chapter in our Prepare Your Home to Sell blog.

Explore Your Options

Whether you’re looking to refinance your loan, buy a home, or sell your current property, it may be the right time to take action to reach your goals. Speak to one of our experienced Mortgage Loan Originators today to review your financial situation and learn more about the loan programs available to you. With the ever-changing market, lower rates won’t last forever. Take advantage of this opportunity while you can!

Ready to learn more?

Connect with one of our loan officers in your area today.

Ready to learn more?

Why Choose FBC Mortgage?

FBC Mortgage, LLC is a leader in helping home buyers with fast and simple loans. We’re dedicated to exceptional customer service and are always available when you need us most, even at night and on the weekend. We’ll help you navigate your new home purchase, and keep you updated along the way with weekly check ins, so you know you’re taken care of. That’s one of the many reasons why 95% of our clients would recommend us to their friends and family. It’s also why the nation’s top home builders and Realtors trust FBC to help their new home buyers.

Buying a home is one of the most important financial decisions you will make. Understanding mortgages and the home buying process can help make it less stressful, and so can partnering with a mortgage lender you can trust. At FBC Mortgage, LLC, we’re dedicated to helping home buyers finance their dream home.

All information presented is for educational purposes only and not intended as financial advice. FBC Mortgage, LLC is a national mortgage lender headquartered in Orlando, Florida. Specializing in residential mortgage lending, including purchase, refinance, construction, and renovation loans. See what our clients have to say. NMLS#152859 EHL ©2024.

How Appraisals Work

Appraisals play a vital role in determining the value of a property, and they help ensure that the investment you’re making is a smart decision for both you and your lender.

What the Fed’s Rate Cut Means for Mortgages

When the Federal Reserve cuts rates, many assume that mortgage rates will follow suit. In this article, we’ll look at the relationship between the federal funds rate and mortgage rates and the potential outlook for both.

What Is A Rate Float Down?

Lower payments, peace of mind, and added flexibility make a rate float down an attractive option. In this article, we’ll explain what a rate float down is and how it could benefit you in your homebuying journey.